estate tax return due date 1041

Fin CEN 114 FBAR. Income Tax Return for Estates and Trusts.

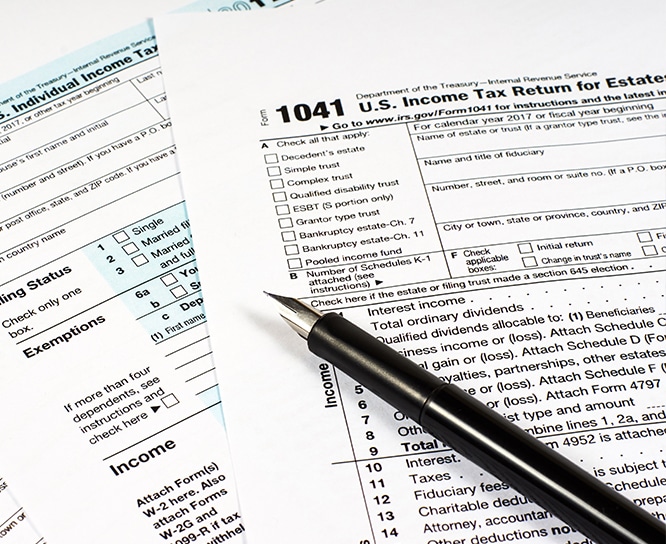

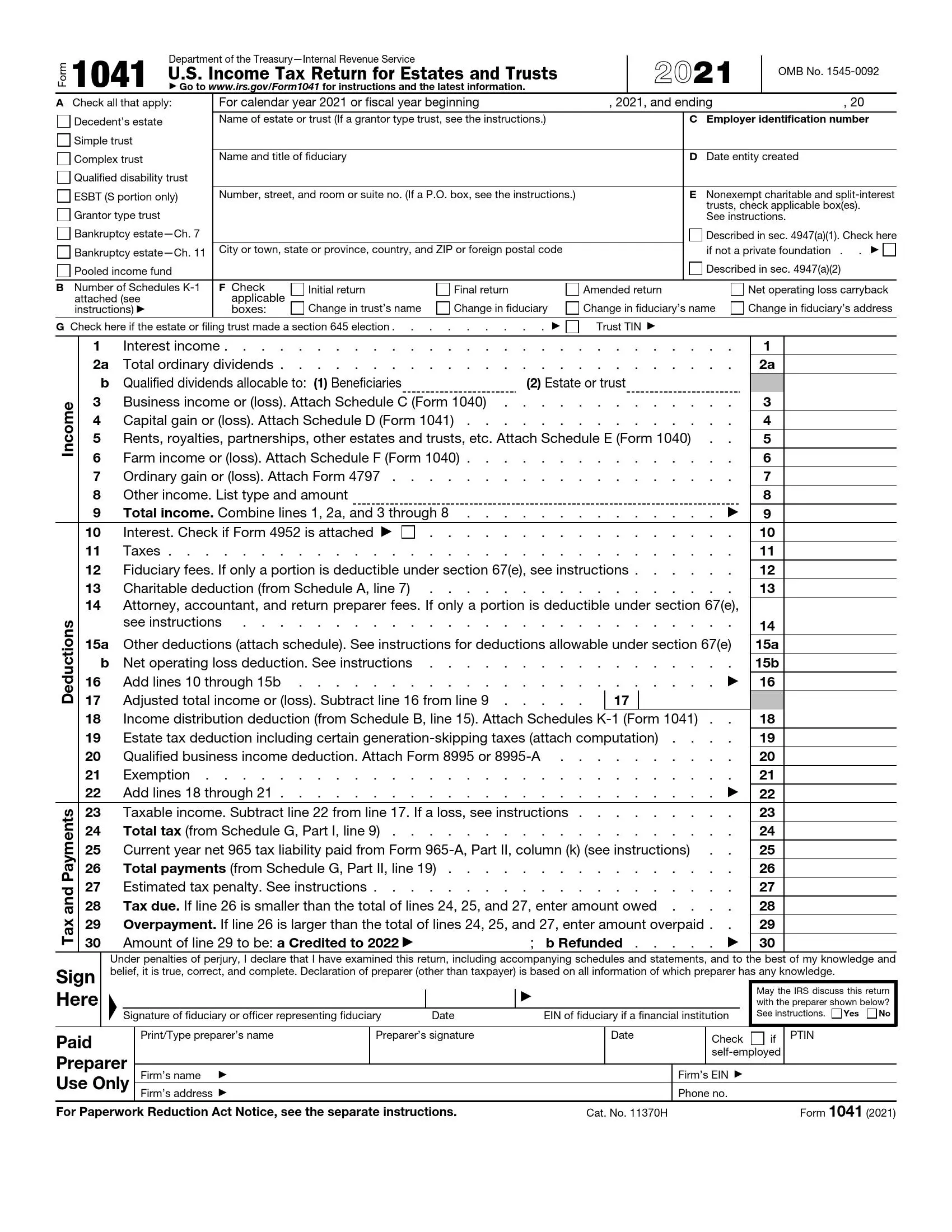

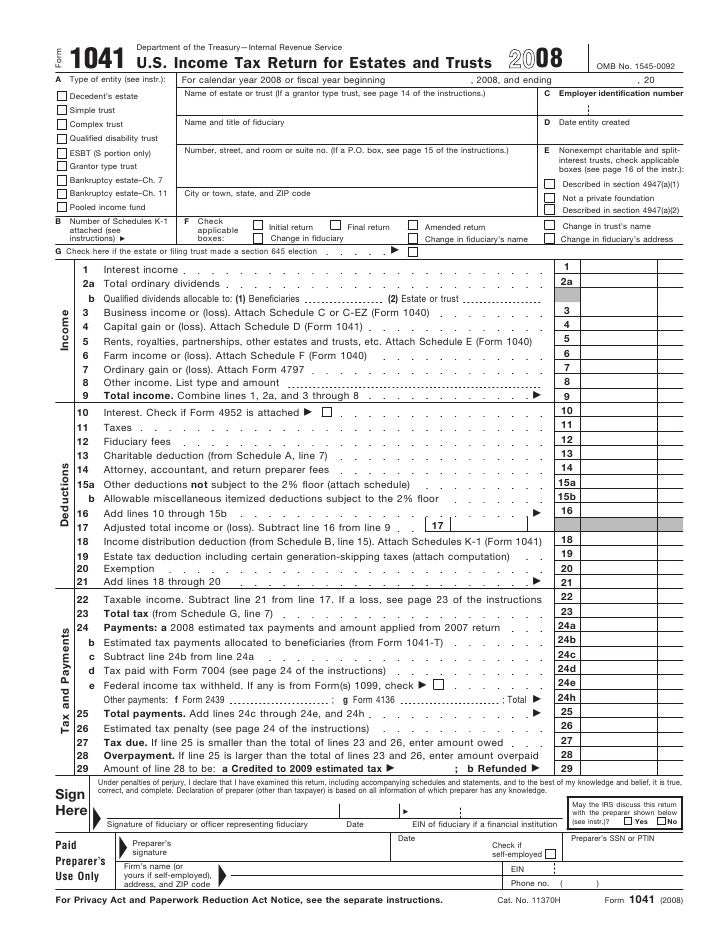

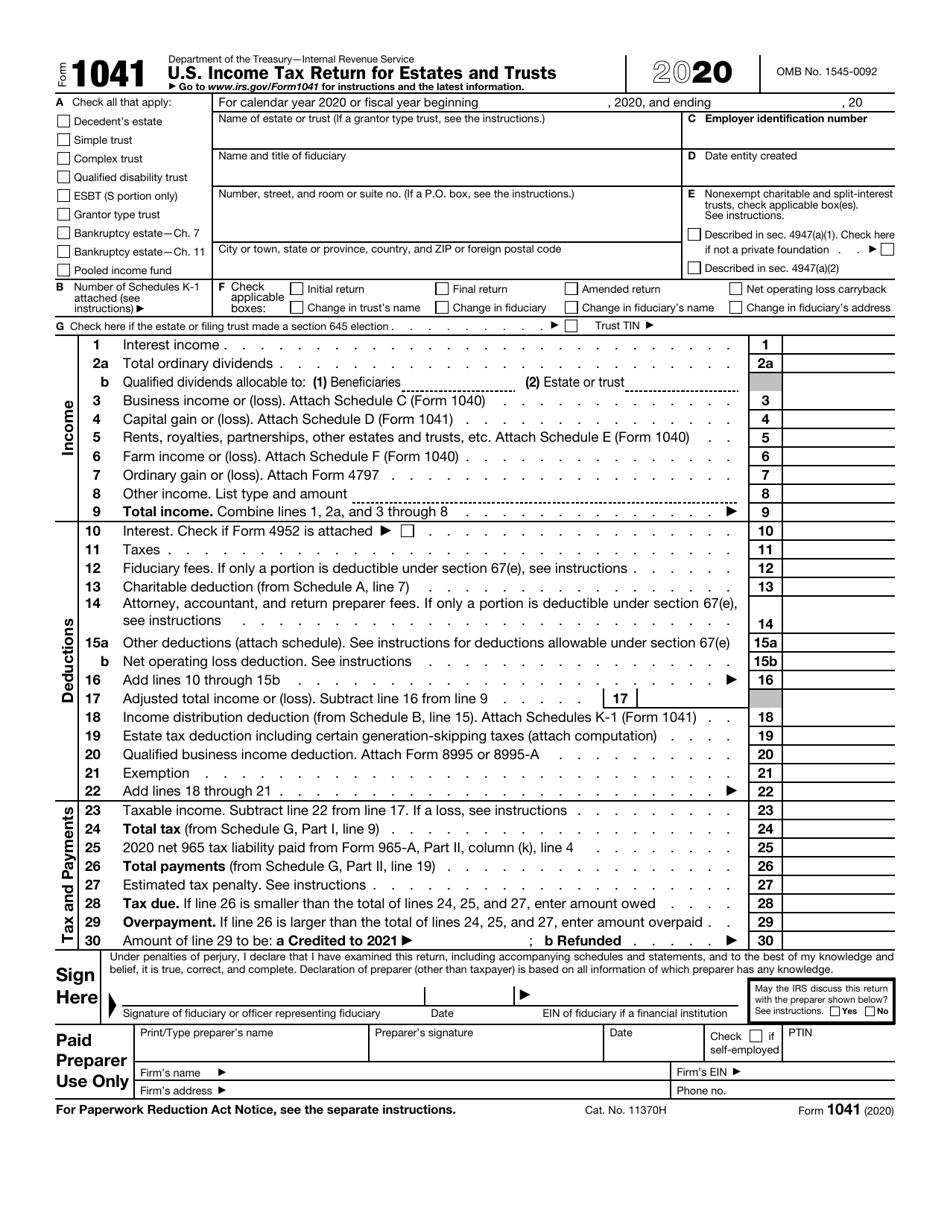

Form 1041 U S Income Tax Return For Estates And Trusts Form 1041

In this case the estate income.

. BTW a Trust and Estate Income Tax Return is often called a Fiduciary Income Tax Return. IRS Form 1041 US. It depends on the value of the estate.

A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or gross income of 10000 regardless of net income or that has an alternative minimum tax liability. For calendar year estates and trusts file Form 1041 and IRS Schedule K-1 on or before tax day. You are essentially correct cap gains usually excluded but can definitely be included under certain circumstances consistent with law and the trust doc and that term DNI is defined in the.

If the Form 1041 deadline slipped your mind or you just realized you need to file there is still time to request an extension. The return is due 3 months and 15 days after the last day of the fiscal year. Can the estate pay the tax if the income has not been distributed avoiding K-1 to beneficiaries.

Federal gift tax returns are ordinarily due on the earliest of the following dates. Its due on April 15 of the following year or on the fifteen day of the fourth month if the. If you live in Maine or Massachusetts you have until April 19 2022.

31 of the same year. Form 1120S for S-corporations 15th March 2022. The executor of the estate is responsible for filing a Form 1041 for the estate.

The decedent and their estate are separate taxable entities. Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post. Correction to the 2020 Instructions for Schedule K-1 Form 1041 -- 15-JUL-2021.

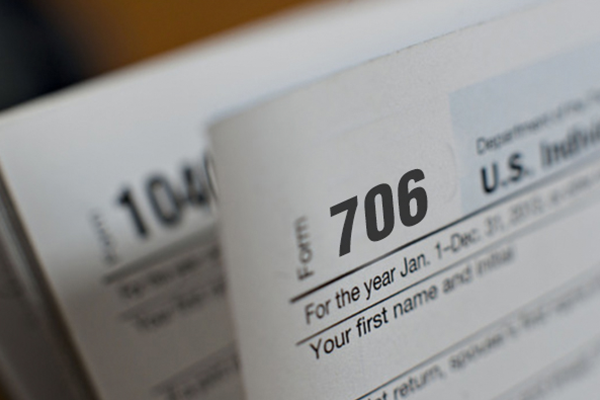

Due date of return. Form 1041 is only required if the estate generates more than 600 in annual gross income. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death.

For the 2021 calendar year estates and trusts taxpayers the due date to file Form 1041 and Schedules K-1 is by April 18 2022. Due Date For Filing. Form 1041 for Trusts and Estates 18th April 2022.

An estates tax ID number is called an employer identification. Refer to IRS Form 706. Theres a Decedents estate box at the top the form which you should check.

Form W-2 W3 1099 NEC and 1096 NEC. 3 However not every estate needs to file Form 706. Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etc.

Typically the estate calendar year starts on the day of the estate owners death and ends on Dec. Differences in preparing Form 1040 and Form 1041. Differences in preparing Form 1040 and Form 1041.

13 rows Only about one in twelve estate income tax returns are due on April 15. California Income Tax Return for the Estate. Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed.

If you choose a fiscal year file a Form 1041 that covers the period May 2 2018 - April 30 2019. The due date of the decedents federal estate tax return or April 15th following the year of decedents death. If Form 1041 does not cover calendar year you may not be able to do this Many items that are deductible on Form 1040 can be deducted on Form 1041.

Calendar year estates and trusts must file Form 1041 by April 18 2022. For calendar-year file on or before April 15 Form 1041 US. The due date of the decedents federal estate tax return or April 15th following the year of decedents death.

There are notable exceptions to this. The return is due April 15 2019. Theres a Decedents estate box at the top the form which you should check.

More Help With Filing a Form 1041 for an Estate. Form 1065 for Partnerships 15th March 2022. The estate tax year is not always the same as the traditional calendar tax year.

For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041. For fiscal year estates and trusts file Form 1041 and Schedules K-1 by the 15th day of the 4th month following the close of the tax year. Form 1041 for simple estate says taxes are due.

For example an estate that has a tax year that ends on June 30 2021 must file Form 1041 by October 15 2021. Before filing Form 1041 you will need to obtain a tax ID number for the estate. The Form 1041 return is similar to the personal income tax return Form 1040 that we all file every April 15.

What is the due date for IRS Form 1041. During the tax year did the estate or trust receive a distribution from or was it the grantor of or transferor to a. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia even if you dont live in the District of Columbia.

For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year. For help in determining when tax returns are due for a deceased individual in a particular year read the IRS Instructions for Form 1041 and Schedules A B G J and K-1. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020.

If line 26 is smaller than the total of lines 24 25 and 27 enter amount owed. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Form 1040 for Individuals 18th April 2022.

Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. These additional forms returns apply to certain. Federal gift tax returns are ordinarily due on the earliest of the following dates.

Form 1120 for C-Corporations 18th April 2022. There is an important distinction regarding the timeline of filing Form 1041. If the deceased persons estate earned income after the date of their death such as interest on a bank account or dividends from investments you may need to file a second income tax return Form 1041 for estates and trusts.

Form 1041 income tax return for estates and trusts is due April 15th July 15th for 2019 Fed 1041 and see link below for state dues for 2019 for calendar year estatestrusts or by the 15th day of the 4th month following the close of the tax year for fiscal year estatestrusts. Many charitable trusts and recipients of trusts and estates are required to file Form 1041 by this due date. The upcoming April 15 2021 income tax deadline doesnt only apply to businesses.

When is Form 1041 Due.

Irs Form 1041 Estates And Trusts That Must File Werner Law Firm

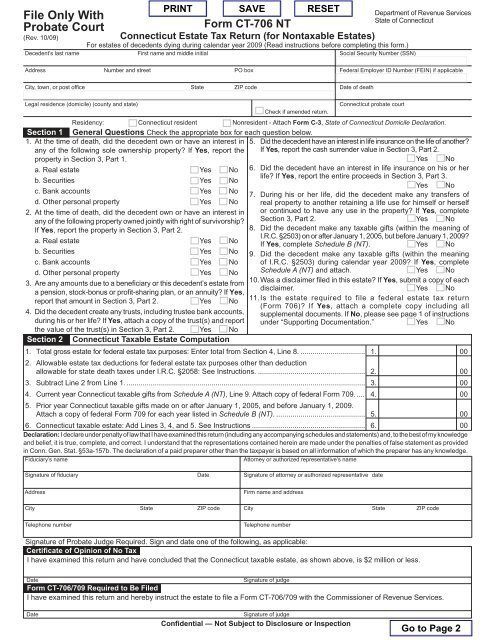

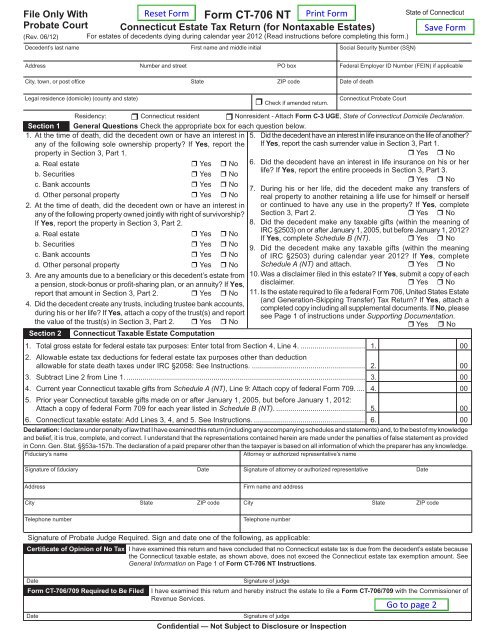

Ct 706 709 Nt Connecticut Estate Tax Return For Ct Gov

Ct 706 Nt Connecticut Estate Tax Return For Nontaxable Ct Gov

Boca Raton Estate Tax Returns Florida Probate Law Firm

The Basics Of Fiduciary Income Taxation The American College Of Trust And Estate Counsel

Estate Income Tax Return When Is It Due

Filing Taxes For Deceased With No Estate H R Block

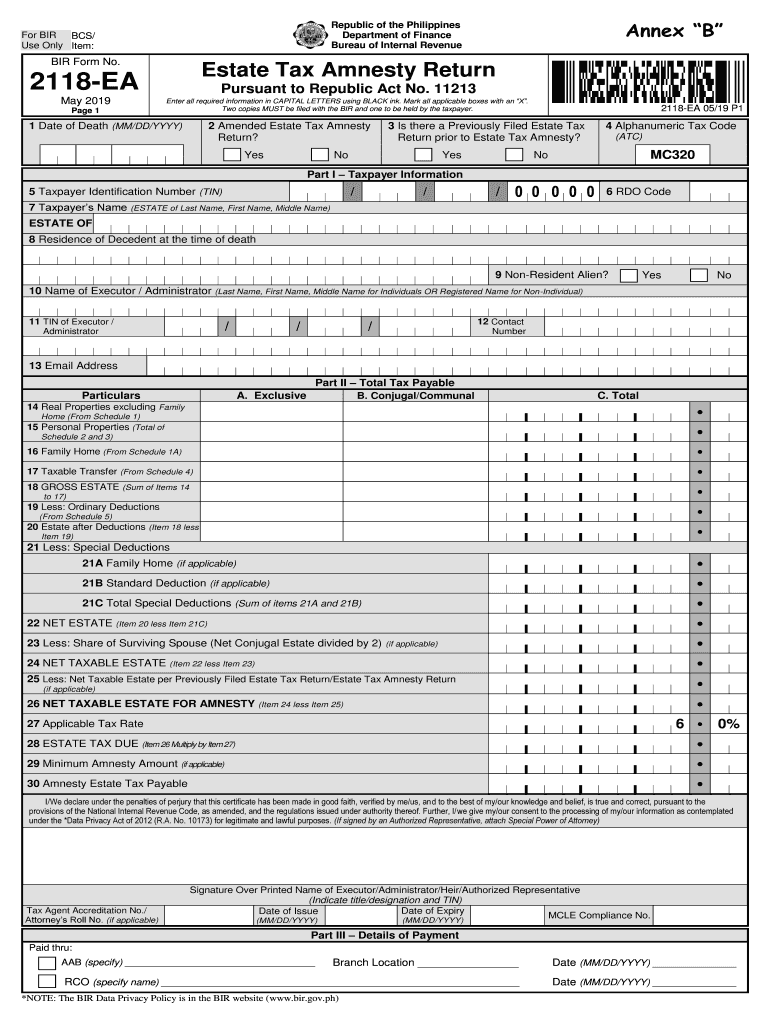

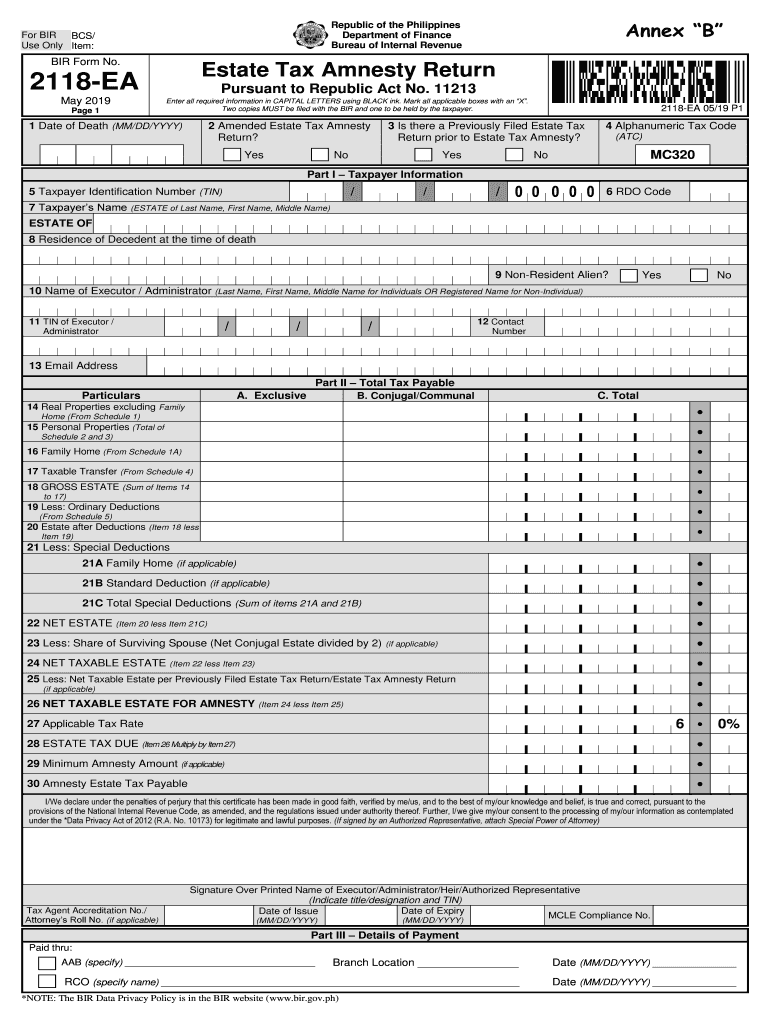

Estate Tax Amnesty Return Fill And Sign Printable Template Online Us Legal Forms

Irs Form 1041 Fill Out Printable Pdf Forms Online

Estate Tax Information Noevalleylaw

Estate And Trust Tax Return Organizer Form 1041

File Form 706 Federal Estate Tax Return By Patti Spencer Estategenie Blog

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

Your Guide To Filing Form 1041 U S Income Tax Return For Estates And Trusts Taxact Blog

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Form 1041 U S Income Tax Return For Estates And Trusts Form 1041

Irs Form 1041 Download Fillable Pdf Or Fill Online U S Income Tax Return For Estates And Trusts 2020 Templateroller

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition